In this article , we analyse the City Union Bank as Investor using publicly available information.

Let’s go straight !

Strengths:

- All-time High Profits and Revenues: The bank reported a Q3 net profit of ₹286 crore, up 13% YoY, with an increase in Net Interest Income (NII) by 14% to ₹587.7 crore.

- Consistent Growth in EPS: Earnings Per Share (EPS) for the quarter ending 30th Sep 2024 was ₹14.28, indicating ongoing growth in earnings.

- Midcap Category Stock: With a market cap of around ₹12,853.62 crore as of late December 2024, City Union Bank falls into the midcap category, suggesting room for growth.

- Recent Stock Performance:

- Share Price: On 30 Dec 2024, the share price closed at ₹172.46, with a day’s high of ₹174.88 and a low of ₹171.33.

- 52-Week Range: The stock has a 52-week high of ₹187.90 and a low of ₹125.40, showing significant volatility but also potential for high returns.

- Moving Averages: The stock has been trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bullish trend.

Weaknesses:

-

Sector Performance: Despite individual growth, the private banking sector has been underperforming relative to other sectors in the last 4-5 years.

Opportunities:

- Digital and Retail Expansion: City Union Bank’s strategy to focus on retail digital lending and secured retail lending could capitalize on the growing demand for digital banking services.

- Geographical Diversification: The bank aims to diversify its geographical presence, potentially tapping into new markets or strengthening its hold in existing ones.

- Improved Asset Quality: Gross NPA has decreased to 3.36% and Net NPA to 1.42%, suggesting an opportunity to improve investor confidence and possibly lower funding costs .

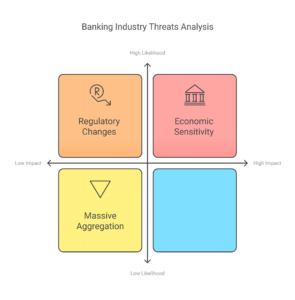

Threats:

- Massive Aggregation: The banking landscape is witnessing consolidation, which might increase competition from larger, more aggregated banks.

- Economic Sensitivity: As a bank, its performance is closely tied to economic conditions, interest rate changes, and regulatory environments, all of which can pose significant risks.

- Regulatory Changes: Any new banking regulations could increase compliance costs or change the competitive dynamics, impacting profitability.

Conclusion:

City Union Bank’s recent financial performance has been strong, with profitability and growth in key financial metrics like EPS and NII. The stock’s performance has been positive, trading at or near its 52-week high, which reflects investor confidence.

However, the broader market conditions for private banks, sectoral performance, and external economic factors remain areas of concern that the bank must manage to sustain its growth trajectory. This analysis should be paired with ongoing market analysis to keep abreast of any changes in stock performance or market conditions.